COBRA Confusion Continues to Challenge Employers

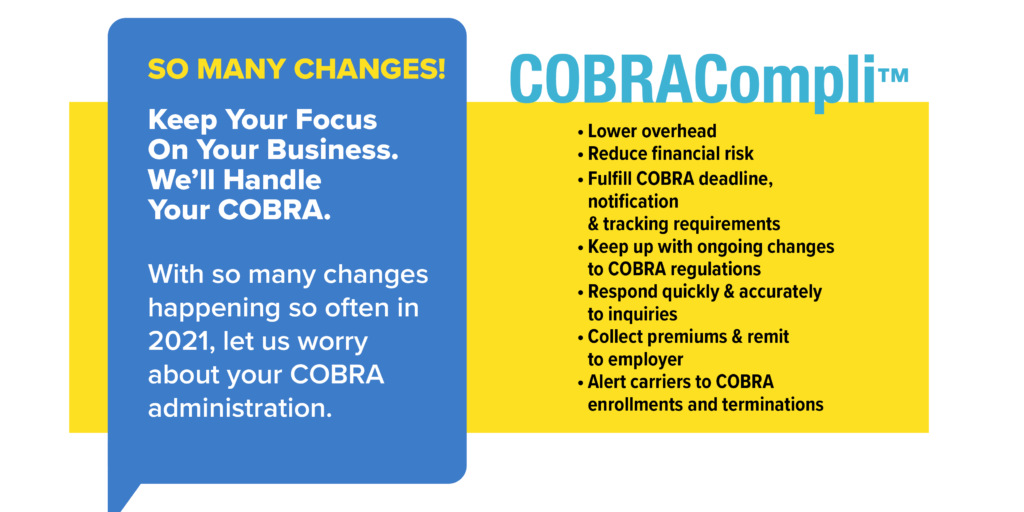

Stay compliant with COBRA changes using COBRACompli from MyHRConcierge.

COBRACompliLast Updated on November 3, 2023

COBRA has always had its difficulties. However, the normal difficulties that employers have faced in keeping up with the technical requirements of COBRA have been exacerbated during the past two years as COBRA rules were changed to recognize the complications accompanying the COVID-19 pandemic.

This result of this confusion is that it can result in Employee Retirement Income Security Act (ERISA) penalties, an excise tax, unintended self-insurance of medical claims, and litigation, including class-action lawsuits.

What Employers Should Know About COBRA

Updated Model COBRA Notices

On May 1, 2020, the Department of Labor (DOL) published a new model general COBRA notice and a new model election COBRA notice. The primary update to the DOL model notices is an added section for those considering Medicare in lieu of COBRA. Use of the model notices, if properly adapted for the specifics of an employer’s group health plan, is considered good faith compliance with the notice content requirements of COBRA. The model notices are available on the DOL website.

Extended COBRA Deadlines

On April 29, 2020, the DOL and Internal Revenue Service (IRS) issued a Joint Notice extending many deadlines relating to COBRA, including the deadlines for an individual to elect COBRA coverage and pay COBRA premiums. Generally, the deadlines were extended by requiring plans to disregard the period from March 1, 2020, until 60 days after the announced end of the COVID-19 National Emergency (known as the “outbreak period”). The DOL later issued guidance clarifying that a COBRA deadline cannot be delayed for more than one year after the date of the original deadline.

This extension of COBRA deadlines is still in effect. An employer should consider revising its standard COBRA notices to reflect the extended deadlines or provide a supplemental notice explaining the revised deadlines.

[Note: On Feb.18, President Joe Biden formally extended the COVID-19 National Emergency, which was set to expire on March 1, 2022, by up to another year unless ended earlier by executive order. ]

ARPA COBRA Subsidy

The American Rescue Plan Act (ARPA) included a provision to fully subsidize COBRA premiums for a period of up to six months from April 1, 2021, through Sept. 30, 2021, for individuals who lost health coverage (including dental and vision) due to involuntary termination or reduction in hours since November 2019.

The DOL issued model ARPA COBRA notices and guidance, which required health plans to notify eligible employees about the availability of the subsidy.

The IRS followed with its own expansive guidance on the ARPA subsidy and related tax credit issues for those employers paying for the subsidy.

Though the COBRA premium subsidy ended on Sept. 30, 2021, employers that did not administer the ARPA subsidy provisions correctly may still need to take actions to mitigate their risks (COBRA’s existing penalty structure also applies to failures relating to ARPA subsidies).

Increase in COBRA Litigation

Even before the above changes went into effect, there had been an explosion of class action litigation under COBRA. These cases usually alleged a purely technical violation of the content requirement of the COBRA notice, showing little or no actual harm to the plaintiff class members.

With the complexity of COBRA administration in the past two years, these class action lawsuits will likely continue to take advantage of the situation. Consequently, it is essential that employers take steps to mitigate their exposure.

Get COBRA Compliance Help from MyHRConcierge

Source: SHRM