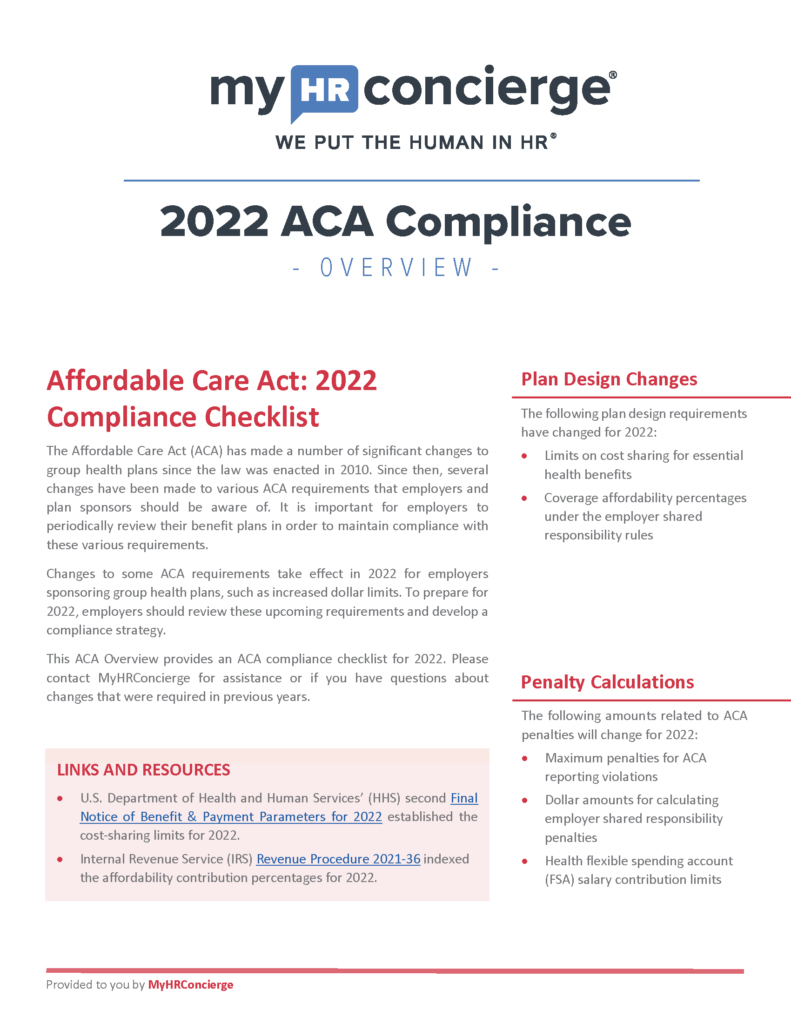

2022 ACA Compliance Overview

Last Updated on November 11, 2021

The Affordable Care Act (ACA) has made a number of significant changes to group health plans since the law was enacted in 2010. Since then, several changes have been made to various ACA requirements that employers and plan sponsors should be aware of. It is important for employers to periodically review their benefit plans in order to maintain compliance with these various requirements.

Changes to some ACA requirements take effect in 2022 for employers sponsoring group health plans, such as increased dollar limits. To prepare for 2022, employers should review these upcoming requirements and develop a compliance strategy.

This ACA Overview provides an ACA compliance checklist for 2022. Please contact MyHRConcierge for assistance or if you have questions about changes that were required in previous years.

CLICK HERE TO DOWNLOAD THE ENTIRE PDF.