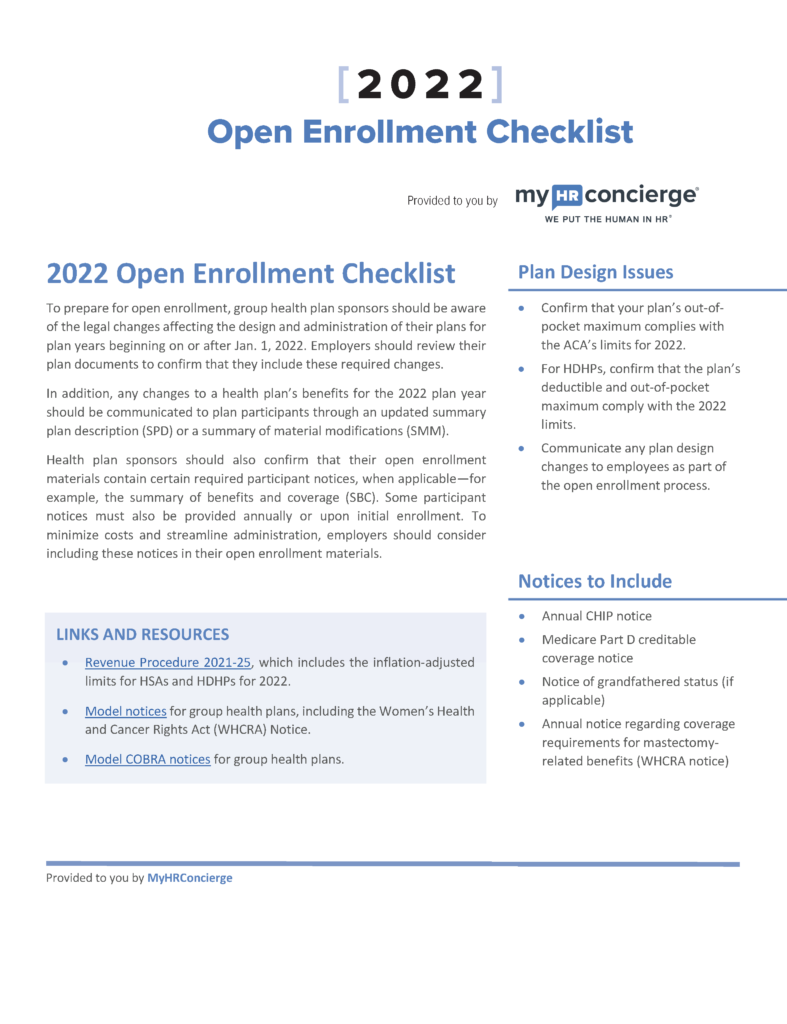

2022 Open Enrollment Checklist

To prepare for open enrollment, group health plan sponsors should be aware of the legal changes affecting the design and administration of their plans for years beginning on or after Jan. 1, 2022. Employers should review their plan documents to confirm that they include these required changes.

Download the Checklist (PDF)Last Updated on May 11, 2022 by MyHRConcierge

In addition, any changes to a health plan’s benefits for the 2022 plan year should be communicated to plan participants through an updated summary plan description (SPD) or a summary of material modifications (SMM).

Health plan sponsors should also confirm that their open enrollment materials contain certain required participant notices, when applicable—for example, the summary of benefits and coverage (SBC). Some participant notices must also be provided annually or upon initial enrollment. To minimize costs and streamline administration, employers should consider including these notices in their open enrollment materials.

Plan Design Issues

- Confirm that your plan’s out-of-pocket maximum complies with the ACA’s limits for 2022.

- For HDHPs, confirm that the plan’s deductible and out-of-pocket maximum comply with the 2022 limits.

- Communicate any plan design changes to employees as part of the open enrollment process.

Notices to Include

- Annual CHIP notice

- Medicare Part D creditable coverage notice

- Notice of grandfathered status (if applicable)

- Annual notice regarding coverage requirements for mastectomy-related benefits (WHCRA notice)

Links and Resources

- Revenue Procedure 2021-25, which includes the inflation-adjusted limits for HSAs and HDHPs for 2022.

- Model notices for group health plans, including the Women’s Health and Cancer Rights Act (WHCRA) Notice.

- Model COBRA notices for group health plans.