Work Opportunity Tax Credit Available Through Dec. 31, 2020

Last Updated on October 29, 2020

Claim the WOTC for Targeted Groups

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers. They must hire individuals from certain “targeted groups” that have consistently faced significant barriers to employment.

An employer may claim the WOTC for wages paid to these individuals during their first year of employment, as long as they are hired before Dec. 31, 2020, and work at least 120 hours for the employer during that first year. Calculate the credit as:

- 25% of the wages paid to an employee who worked between 120 and 400 hours; or

- 40% for an employee who worked more than 400 hours.

These amounts are subject to maximums that depend on the employee’s targeted-group classification.

Initially enacted in 2007, the WOTC was originally set to expire at the end of 2019. On Dec. 20, 2019, however, the WOTC was extended for another year, allowing employers to claim it for employees hired on or before Dec. 31, 2020. This Compliance Overview contains more information about the WOTC, as provided by the Internal Revenue Service.

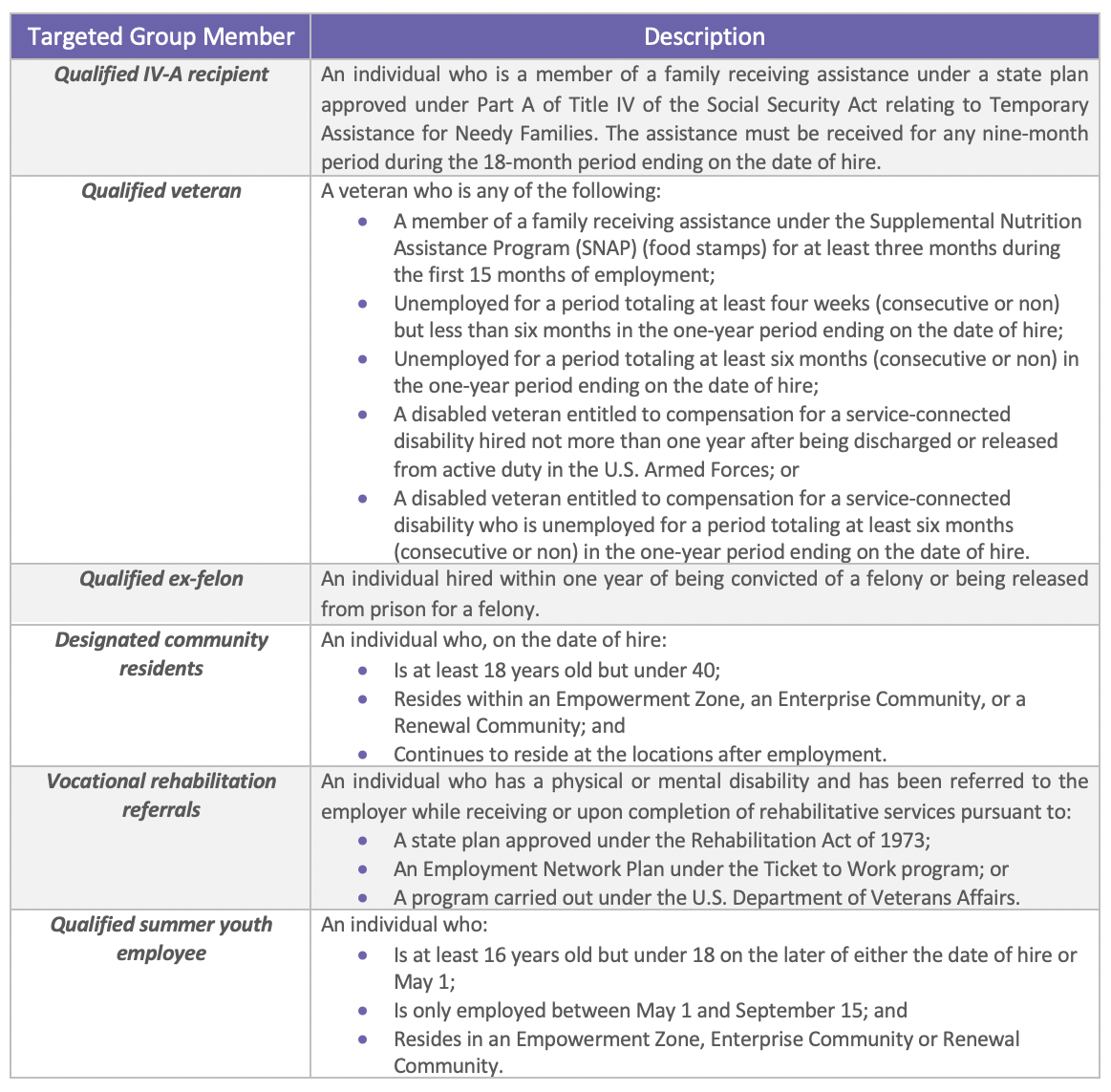

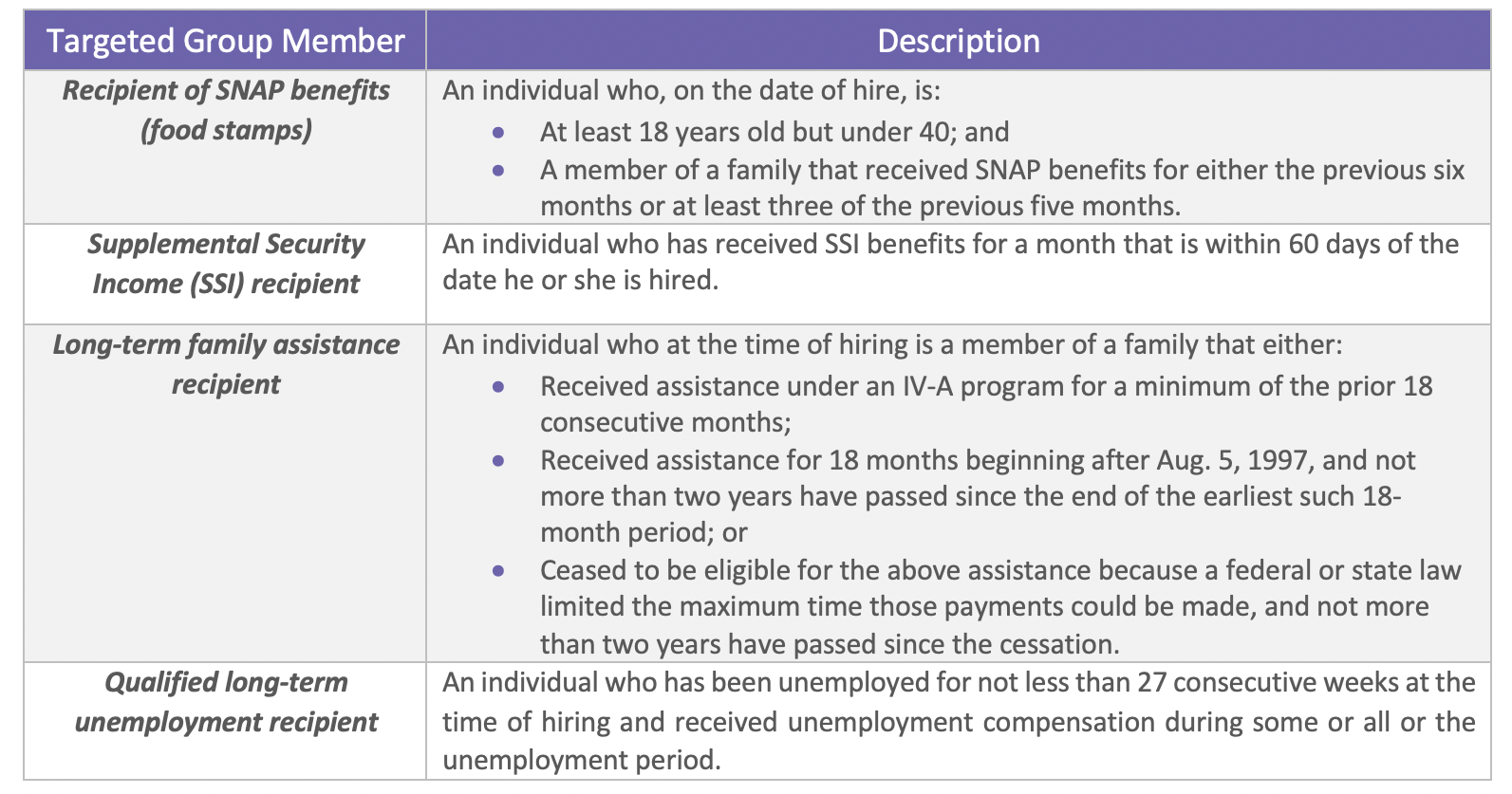

Targeted Groups

The table below lists and describes the types of individuals who fall within the “targeted groups” for purposes of the WOT credit.

Certification Requirement

An employer must obtain certification that an individual is a member of the targeted group before the employer may claim the credit. An eligible employer must file Form 8850 (Pre-Screening Notice and Certification Request for the Work Opportunity Credit), with the appropriate state workforce agency within 28 days after the eligible worker begins work.

Employers should contact their individual state workforce agency with any specific processing questions for Forms 8850.

Limitations on the WOTC

The credit is limited to the amount of the business income tax liability or social security tax owed.

A taxable business may apply the credit against its business income tax liability—the normal carry-back and carry-forward rules apply. The Instructions for Form 3800, General Business Credit, provide more details.

For qualified tax-exempt organizations, the credit is limited to the amount of employer social security tax owed on wages paid to all employees for the period the credit is claimed.

Claiming the Credit

Taxable Employers

After the required certification is secured, taxable employers claim the tax credit as a general business credit. Use Form 3800 against your income tax by filing the following:

- Form 5884 (with instructions);

- Form 3800 (with instructions); and

- The business’ related income tax return and instructions (such as Forms 1040 or 1040-SR, 1041, 1120).

Tax-Exempt Employers

Qualified tax-exempt organizations described in Internal Revenue Code (IRC) Section 501(c) and exempt from taxation under IRC Section 501(a) may claim the credit for qualified veterans who begin work on or after Dec. 31, 2014, and before Jan. 1, 2021.

After the required certification (Form 8850) is secured, tax-exempt employers claim the credit against the employer social security tax by separately filing Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans.

Form 5884-C should be filed after filing the related employment tax return for the period that the credit is claimed. The IRS recommends that qualified tax-exempt employers do not reduce their required deposits in anticipation of any credit. The credit will not affect the employer’s Social Security tax liability reported on the organization’s employment tax return.

Recordkeeping

Employers must keep copies of the forms it files for the WOTC, along with any related correspondence between them and their state WOTC coordinators, for as long as these documents may be needed for the administration of the credit. Records that support the credit usually must be kept for three years from the date any income tax return claiming the credit is due or filed, whichever is later.

Source: Internal Revenue Service @Zywave

Questions about Qualified Recipients of the WOTC?

MyHRConcierge can help consult with you about any human resource issue, including issues related to the Work Opportunity Tax Credit. For a free consultation, please contact us.