Affordable Care Act (ACA) Reporting Year-end Guidance

Last Updated on April 3, 2025

As we approach year’s end, employers must be diligent in ensuring compliance with the Affordable Care Act (ACA) reporting requirements. The ACA demands meticulous record-keeping and reporting, leaving no room for error. Failure to do so can lead to significant penalties and fines:

- Penalty A – Penalty of $2,970 for calendar year 2024 ($2,900 for calendar year 2025) per full time employee minus the first 30 will be incurred for failure to provide minimum essential coverage to at least 95 percent of the full-time employees and their dependents if any full-time employee obtains coverage through the exchange

- Penalty B – Penalty of $4,460 for calendar year 2024 ($4,350 for calendar year 2025) for each full-time employee who receives subsidized coverage through an exchange in a month if they are not offered insurance that is affordable or that meets minimum value, and one or more full-time employees receive subsidized coverage through an exchange.

The following are tasks designed to help you navigate the regulatory landscape and meet the upcoming Affordable Care Act reporting deadlines with ease.

Table of contents

- Review Your Affordable Care Act Reporting Obligations

- Determine Employee Contribution Affordability

- Measurement Period Calculations for Variable Hour Employees

- Verify Employee Data

- Track and Confirm Coverage Information

- Prepare and Review the Required ACA Forms

- Distribute Forms to Employees

- File Forms with the IRS

- Maintain Compliance Documentation

- Evaluate ACA Compliance Strategies

- ACA Filing Requirements for Small Groups

- MyHRConcierge Can Ease Your ACA Reporting Reporting Pains

Review Your Affordable Care Act Reporting Obligations

- Familiarize yourself with ACA mandates and how they apply to your organization.

- Applicant Large Employers (ALE) and companies of any size that offer self-insured programs are required to file 1094 and 1095 forms.

- Determine if you are an Applicant Large Employer (ALE), typically having 50 or more full-time employees, including full-time equivalent employees.

- In order to stay out of the “penalty box”, per Misty Baker, Director of Compliance and Government Affairs at BenefitMall, ALE requirements and reporting obligations include offering “the right kind of coverage, at the most affordable price, for the eligible employee only.”

- Get acquainted with IRS forms 1094, 1095, and other related forms and instructions.

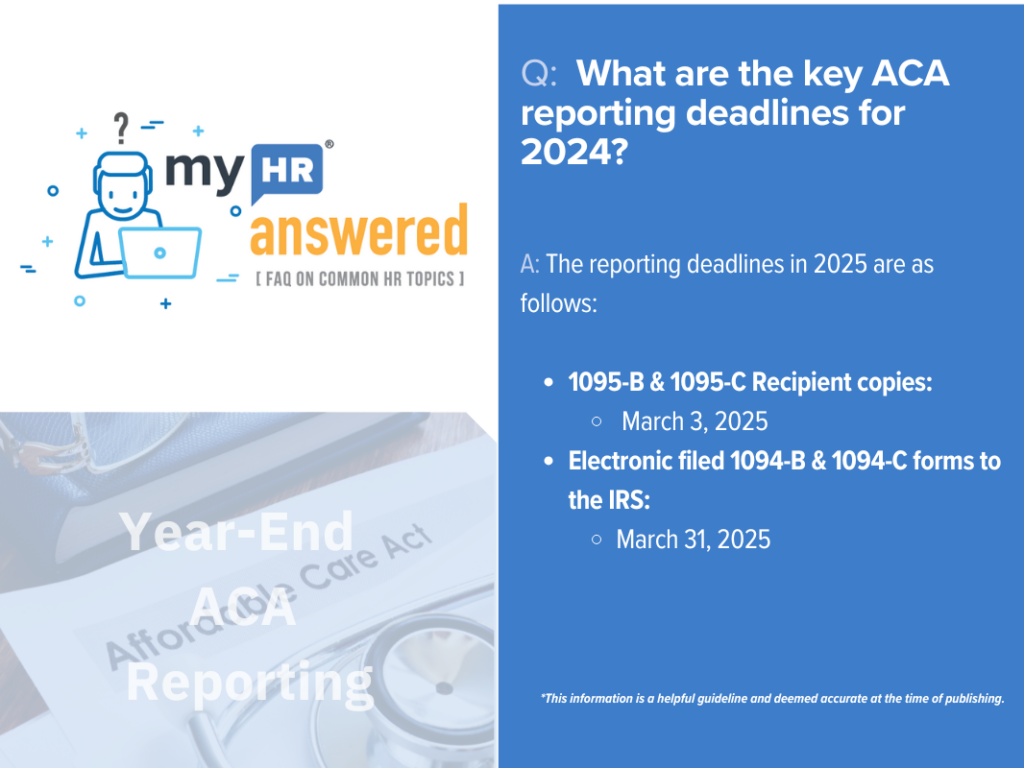

- Mark the reporting deadlines on your calendar. The reporting deadlines in 2025 are as follows:

- 1095-B & 1095-C Recipient copies – March 3, 2025

- Electronic filed 1094-B & 1094-C forms to the IRS – March 31, 2025

- Paper filed 1094-B & 1094-C forms to the IRS – February 28, 2025

- Extensions – Employers can get automatic 30 day extensions of time to file by completing Form 8809 and filing it with the IRS on or before the due date for the forms.

- If filed within 30 days, pay $60 per form.

- If filed after 30 days, but by August 1, 2025, pay $120 per form.

- If filed after August 1, 2025, pay $310 per form.

- Intentional disregard for filing, pay $630 per return with no cap.

Determine Employee Contribution Affordability

- As noted above, affordability plays a significant role in mitigating potential penalties. It is important to perform an assessment at each open enrollment to ensure your offerings are affordable. As part of this assessment, you should determine if you are going to utilize one of the following safe harbors:

- Rate of Pay – Determines the coverage as affordable if the employee’s premium share is not greater than the monthly wages multiplied by the IRS-specified percentage. The monthly wages are derived from the employee’s hourly rate multiplied by 130 for hourly workers, while the monthly salary is considered for salaried individuals.

- W2 – Premiums share of the employee does not go beyond the yearly IRS-stipulated percentage of the employee’s W-2 wages from that employer for that year.

- Federal Poverty Rate – Safe harbor is satisfied when the employee’s premium share is less than the prescribed IRS percentage of the Federal Poverty Line for a single person for that year.

- Note: Go HERE to download an ACA Affordability Calculator.

- Affordability Rates:

- 8.39% for 2024

- 9.02% for 2025

Measurement Period Calculations for Variable Hour Employees

- Measurement periods help determine the full-time status of variable hour employees, impacting the offer of coverage and potential penalties. Failure to offer coverage to eligible employees can lead to Penalty A noted above.

- Conduct accurate measurement period calculations to ascertain the average hours worked by variable hour employees. This step should be performed throughout the year to ensure employees that meet the required threshold are offered coverage in a timely manner.

- Document and retain all data and calculations related to the measurement periods, demonstrating due diligence in compliance.

Verify Employee Data

- Ensure all employee data such as names, social security numbers, and addresses are accurate and up to date. The names that are reported should match the names on the social security cards.

- Rectify any discrepancies in the employee data to prevent penalties related to incorrect or incomplete information.

Track and Confirm Coverage Information

- Verify the months each employee was offered and whether they enrolled or waived the coverage in a healthcare plan.

- Document whether the offer met the affordability and minimum value of the health coverage offered to each employee.

Prepare and Review the Required ACA Forms

- Start preparing forms early to provide ample time for review and corrections.

- Ensure forms are filled out completely and accurately to avoid potential penalties.

- Utilize an ACA reporting service that can determine the appropriate coding of lines 14 and 16 to reduce the risk of audit and penalties.

Distribute Forms to Employees

- 1095 Form Distribution: As of 2025, employers are no longer required to distribute IRS Forms 1095 to employees. Instead, they must issue a clear, conspicuous and accessible notice informing employees that they may request the form. Employers must furnish the form no later than January 31st of the following year or, if later, 30 days after the request is made.

- Distribute the required 1095 forms to all full-time employees by the specified deadline, March 3, 2025.

- Ensure forms are sent via mail or obtain consent to provide the forms electronically. MyHRConcierge’s ACACompli can print and mail the forms for the employer if desired.

File Forms with the IRS

- Submit forms 1094 and 1095 to the IRS by the specified deadline, March 31, 2025, if filing electronically, or February 28, 2025, if filing via paper.

- Make sure you file the forms in the appropriate manner to the IRS. Beginning in 2024, employers that file 10 or more forms with the IRS are required to e-file the forms to the IRS.

- Utilizing an ACA reporting service can provide a tested and efficient process to e-file your forms to the IRS.

- According to Misty Baker of BenefitMall, if you have companies filing these forms for you, ensure that you are vetting them- “…make sure you ask them the hard questions: does your company know about a rehire provision and how that’s counted to your ALE count? How does that person get counted? And so on and so forth. You need to be asking your vendors hard questions, making sure they can answer them and that they have adaptable software.”

Maintain Compliance Documentation

- Keep a well-organized record of all ACA compliance documentation.

- Document any waivers, measurement period calculations, or other applicable ACA items.

Evaluate ACA Compliance Strategies

- Review and assess the effectiveness of your ACA compliance strategies, making adjustments as necessary for the upcoming year.

- Stay updated on any changes in ACA regulations and reporting requirements for the following year.

Compliance with Affordable Care Act reporting requirements is critical for employers to ensure they do not incur large penalties. By following this comprehensive checklist, employers can confidently navigate the reporting season, ensure compliance, and focus on a prosperous year ahead. Remember, the key to a successful reporting process lies in thorough preparation, accurate calculations, and seeking professional guidance when necessary.

ACA Filing Requirements for Small Groups

The ACA mandates that applicable large employers (ALEs) with 50 or more FTEs file and furnish certain forms annually. However, small groups (those with fewer than 50 FTEs) are not exempt from all ACA obligations, especially when they offer self funded health plans, such as level-funded arrangements.

Employers with level-funded plans are considered self-insured for ACA purposes, meaning they must:

- Provide Form 1095-B to employees, detailing the months each individual had Minimum Essential Coverage (MEC).

- File Form 1094-B (transmittal form) along with copies of the Form 1095-B to the IRS.

A common misconception is that health insurance carriers handle all ACA filing responsibilities. While carriers typically generate Form 1095-B for employers offering level-funded plans, most do not electronically file the forms with the IRS. This leaves small employers responsible for submitting the Forms 1094-B and 1095-B to the IRS.

Historically, the IRS allowed employers with less than 250 forms to mail the forms to the IRS. However, beginning in January 2024 the IRS began requiring any company with 10 or more forms to electronically file them to the IRS. Therefore, it is important to clarify with your carrier whether they just provide the forms to the employer or if they are also e-filing them to the IRS.

MyHRConcierge Can Ease Your ACA Reporting Reporting Pains

MyHRConcierge’s robust ACACompli service can help you simplify your Affordable Care Act reporting. Our Forms Coding + E-file will automatically provide the required codes on the 1095 forms based upon the information you provide.

If you’d like to sign up for our year-end reporting services, you can do so here.

To learn more, contact us today at ccooley@myhrconcierge.com, 855-538-6947 xt 108 or schedule a free consultation below: