Is this COVID-19 Case Work-related?

Last Updated on August 24, 2020

How to Determine Whether a COVID-19 Case Is Work-related

The coronavirus (COVID-19) pandemic has created massive change and concern for employers and employees across the world. Even as businesses reopen and employees return to their new normal, the risk of becoming exposed to and ill with COVID-19 is still present. When an employee reports they have COVID-19, employers face the difficult task of determining whether the employee’s illness is work-related.

This HR Insights piece providea an overview of how employers can determine when a COVID-19 case is work-related. We cover the OSHA requirements for reporting illness and best practices for responding to an employee’s positive COVID-19 test. As is the case with all inherently legal issues, employers are strongly recommended to seek the guidance of legal counsel when faced with any of the claims discussed herein. This article should not be considered legal advice.

OSHA Requirements

The Occupational Safety and Health Act (the Act) requires employers to report and record work-related injuries and illnesses. OSHA has indicated that COVID-19 infections are recordable injuries if they are work-related and they meet the Act’s recording criteria. Recording requirements apply only to employers with more than 10 employees who are not in an exempt, low-risk industry.

In addition, employers must report incidents that result in an employee’s fatality within eight hours. Incidents that result in inpatient hospitalization, amputation or loss of an eye must be reported within 24 hours.

OSHA Guidance on Work-relatedness

An injury or illness is work-related if an event or exposure in the work environment either caused or contributed to the resulting condition or significantly aggravated a preexisting injury or illness. Work-relatedness is presumed for events or exposures in the work environment.

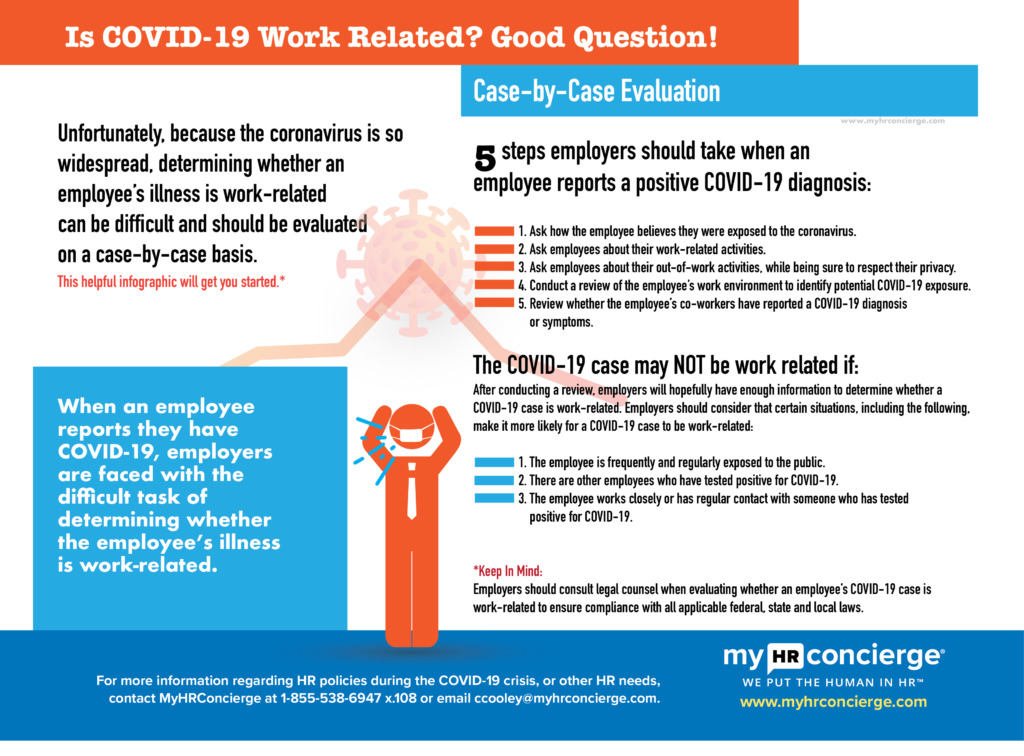

Case-by-Case Evaluation

Unfortunately, because the coronavirus is so widespread, determining whether an employee’s illness is work-related can be difficult. Therefore, the employee should be evaluated on a case-by-case basis. Employers can conduct the following activities when an employee reports a positive COVID-19 diagnosis:

- Ask how the employee believes they were exposed to the coronavirus.

- Inquire about the employee’s work-related activities.

- Ask the employee about their out-of-work activities, while being sure to respect their privacy.

- Conduct a review of the employee’s work environment to identify potential COVID-19 exposure.

- Review whether the employee’s co-workers have reported a COVID-19 diagnosis or symptoms.

After conducting a review, employers will hopefully have enough information to determine whether a COVID-19 case is work-related. Employers should consider that certain situations, including the following, make it more likely for a COVID-19 case to be work-related:

- The employee is frequently and regularly exposed to the public.

- There are other employees who have tested positive for COVID-19.

- The employee works closely or has regular contact with someone who has tested positive for COVID-19.

Employers should consult legal counsel when evaluating whether an employee’s COVID-19 case is work-related. This will ensure compliance with all applicable federal, state and local laws.

DOWNLOAD THIS HELPFUL INFOGRAPHIC TO SHARE IN YOUR OFFICE TODAY!

Recording a Work-related COVID-19 Case

OSHA clarifies that COVID-19 can be a recordable illness if a worker is infected as a result of performing their work-related duties. However, employers are only responsible for recording cases of COVID-19 if all of the following are met:

- The case is a confirmed case of COVID-19 (see Centers for Disease Control and Prevention (CDC) information on persons under investigation and presumptive positive and laboratory-confirmed cases of COVID-19);

- The case is work-related, as defined by 29 CFR 1904.5; and

- The case involves one or more of the general recording criteria set forth in 29 CFR 1904.7 (e.g., medical treatment beyond first aid or days away from work).

OSHA’s definition of a recordable illness includes “both acute and chronic illnesses, such as, but not limited to, a skin disease, respiratory disorder or poisoning.” This definition is limited to abnormal conditions or disorders that exclude the common cold and the seasonal flu. This can make it difficult when employees show up to work with coronavirus-like symptoms, such as a high fever or coughing. For this reason, employers may hold off until they have a confirmed COVID-19 diagnosis before starting a recordability analysis. A confirmed case of COVID-19 means an individual with at least one respiratory specimen that tested positive for SARS-CoV-2, the virus that causes COVID-19.

Reporting a Work-related COVID-19 Case

COVID-19 cases must be reported if they are work-related and result in a fatality (within eight hours), inpatient hospitalization, amputation, or loss of an eye (within 24 hours). The reporting periods begin as soon as the employer learns about the work-related incident. This includes a time delay between the incident taking place and being reported to the employer.

If the OSHA area office is closed, employers are expected to report these incidents by phone. Call 1-800-321-OSHA (6742) or use the reporting application located on OSHA’s public website at osha.gov.

Record Keeping Requirements

Employers with more than 10 employees and whose establishments are not classified as a partially exempt industry must prepare and maintain records of serious occupational injuries and illnesses, using OSHA Forms 300, 300A and 301.

- Form 300 (Log of Work-Related Injuries and Illnesses): Use to classify work-related injuries and illnesses and to note the extent and severity of each case. When an incident occurs, employers must use Form 300 to record specific details about what happened and how it happened.

- Form 300A (Summary of Work-Related Injuries and Illnesses): Shows the total number of work-related injuries and illnesses for the year in each category. At the end of the year, employers must post the Form 300A in a visible location so that employees are aware of the injuries and illnesses occurring in their workplace. Employers must keep a log for each establishment or site. When an employer has more than one establishment, a separate log and summary must be kept at each physical location that is expected to be in operation for one year or longer.

- Form 301 (Injury and Illness Incident Report): Must be filled out within seven calendar days after an employer receives information that a recordable work-related injury or illness occurred. This report includes information about the employee and the treating physician, and detailed information about the case. Employers must keep this report on file for five years following the year it pertains to.

The information collected in these records enables OSHA to determine DART rates for employers and industries. DART stands for “days away, restricted and transferred.” This is a safety metric that helps determine how many workplace injuries and illnesses caused employees to miss work, perform restricted work, or be transferred to another job within a calendar year. OSHA uses data from a three-year sampling period to update the list of partially exempt industries. Industries with a DART rate lower than 75% of the average DART for the sampling period are allowed a partial exemption from recording requirements.

Following these reporting requirements is essential to protecting your organization from potential litigation and OSHA violations. These recordkeeping violations can add up quickly. First-time violations range between $1,000 to $5,000 and willful violations carrying a penalty of $134,937 per violation.

Best Practices for Responding to a COVID-19 Test

When an employee notifies you that he or she is sick with COVID-19, you should respond calmly and empathetically. In these uncertain times, it can be easy to overreact. However, you need to ensure that the infected employee is treated with compassion. Reassure the employee that their identity will remain confidential. Help them coordinate taking leave or paid time off until they’ve recovered.

Without disclosing the identity of the infected employee, directly notify any co-workers or customers with whom the ill employee had been in contact. Be sure to remain calm and let them know that someone they have been in contact with or have been in their physical work area has tested positive for COVID-19. Recommend that they should self-quarantine for the next 14 days and monitor themselves for the symptoms of COVID-19. If feasible, allow eligible employees to work from home during this time.

Be sure to notify the rest of the company by email or letter that an employee has tested positive for COVID-19. Remember to keep the employee’s identity protected and be transparent about your response. The communication should include what steps your company will be taking to protect the health of other employees. If you plan on having employees work from home for the next 14 days or close the office, this information should be disclosed in the communication.

According to the CDC, COVID-19 can remain on hard surfaces for up to 12 hours, creating a potential risk of transmission. Depending on the size of your organization, you may want to consider closing the office for a few days so that it can be thoroughly cleaned and disinfected. All surfaces that the infected employee may have touched should be disinfected. Surfaces include anything high-touch such as countertops, cabinets, doorknobs, handles and chairs.

Summary

The COVID-19 pandemic is widespread across the country. It’s likely that employers may be faced with the difficult situation of responding to an employee’s positive diagnosis and determining whether their illness is work-related. Before making any decisions, employers should consult legal counsel to ensure compliance with all applicable laws.

Discover Our COVID-19 Support Package

Are you with a small to mid size employer? If you need more guidance on how to handle human resources issues regarding COVID-19, we can help. MyHRC offers a COVID-19 Support Package in addition to many other HR-related services.

To get started, schedule a free consultation or call us toll free at (855) 538-6947.